The one where we talk about politics

VC Grifters, Climate, Crypto, and related subjects. #Deepsigh….

It is continually surprising to us, albeit helpful to remember, that there are people who make their living and spend their time far removed from the incoherently resonating echo chambers of technology startups, venture capital, and the political considerations surrounding both. Do we block out their existence out of a virulent sense of envy? Well, only on days that end in Y.

Regardless, we received a text from one such friend this week. About him we will say little, except that he’s a mid-senior exec at a steel company, has a couple of degrees in complex variations of electrical and mechanical engineering, and is a tremendously effective advocate for decarbonizing his industry.

“What the ****** is the deal with the A and Z guys (Ed. Marc Andressen and Ben Horowitz, founders of the massive VC fund Andreesen Horowitz.) coming out for Trump? They tried to raise money from {{redacted}} last year but backed off because he wanted a decarb commit and they wouldn’t do it. They got worse. Who the **** keeps funding these assholes?”

Do we want to write about this? No. Actually, hell no. 2024 US politics are a series of lectures from your drunkest, douchiest uncle, and like that uncle’s facebook feed are best avoided.

But. We think we have to. This is a substack about using climate tech as leverage to decarbonize industry, to stop heating and eventually cool the planet, and generally unfuck the atmosphere so that we can create a world in which our children live better lives than we do. Some of the biggest, most powerful names in tech are doing their best to stop that from happening. So, let’s talk about tech, politics, what it means for climate tech, and what we can do about it.

Priors

We’ve made no particular attempt to hide our political leanings throughout the past year of writing these posts, but just to get it out in the open; We’re probably best described as “Charlie Baker Republicans;” give us low deficits and a balanced budget, a smaller and less interventionist military, massive increases in legal immigration, free markets and pro-innovation policies, the closing of tax loopholes and avoidance schemes, and a government that keeps their noses far away from women making choices about their health and reproduction, or who anyone chooses to love and marry.

What party does that make us in 2024? Annoyed, mostly, but we’ll spare you the rant.

We’ll be voting Democrat in the Presidential election, not because we’re tremendous fans of Kamala Harris and her policies (we’re not), but because Donald Trump is a morally and financially bankrupt lunatic.

And, in among the most interesting intersectional elements between tech and politics, Harris is just better for business.

As we write this piece, the Biden / Harris stock market continues to hover near all-time-highs, job creation is booming, and inflation is way down. Contrast this to Trump’s economy, one the of the chief architects of which, Peter Navaro, is to serious economists what a rat-infested ford pinto is to a new tesla. There is plenty more data available. Trump bungled the Covid response, allowed inflation to rampage, and unbalanced the federal budget by granting massive tax cuts to the wealthy.

In general since WWII, the stock market compounds at much higher rates under democratic presidencies, with real GDP growth, employment, and budget deficits experiencing similarly excellent effects. 10 of the last 11 recessions began under Republican administrations.

The A/B test is clear. Nearly everyone will benefit vastly more from an overall strong economy than from tax optimizations for the top one percent of the one percent. Spare us, please, from any talk of trickle-down economics kicked off by tax cuts for corporations and those who own them. Companies exist to generate returns for shareholders, which they happily provide through the mediums of stock buybacks and rising dividends. Creating jobs is expensive, juicing the stock price is not.

There is no incentive for companies or owners to be honest about what they plan to do with their windfalls under a Republican administration.

Economy

You may be wondering how this is relevant to climate tech. Short version; Existentially. A booming stock market increases valuation multiples as a function of revenue, and draws institutional capital back into early-stage investments. Lower interest rates open up grants, university funding, venture debt, and many other vehicles. Big companies become more risk-tolerant and are willing to work with startups. Deals get done, for partnerships and pilots and M&A. Our friend quoted above will be able, as he badly wants, to bring new decarbonization tools and technologies into every aspect of his vast supply chain.

The early-stage climate ecosystem is currently a tough place to build businesses. We wrote about this phenomenon here. 4 or 8 more years of strong economic growth won’t make it easy, but it’ll get materially easier.

As we write this piece, it’s a sunny, warm summer Saturday, and we’re sitting inside with air conditioning and purifiers blasting. Wildfire smoke from hundreds of miles away has made the air unpleasant to breathe. We need these companies to work.

A, Z, and everyone between

All of what we wrote above regarding the implications of a strong economy is equally applicable to any early-stage technology business, and to the operators, founders, and allocators making their livings therein.

Wait… allocators? What do Marc Andreesen, Ben Horowitz, Peter Thiel, and David Sacks do again?

Between them, the firms led by these men control close to $60bn in AUM, spread between Andreesen Horowitz ($42bn), Thiel’s Founders Fund ($13bn), and Sacks’ Craft Ventures ($3.5bn). They are also considered to be three of Silicon Valley’s bellwether funds, with their investments frequently commanding high valuations, crowded follow-on rounds, and access to the best talent.

This seems weird. VCs make money through liquidity events in their portfolio. Many, many more of those will happen under Harris than Trump. Our longtime readers know that we consider incentives to be close to a law of physics; omnipresent and generally the guiding principle of any situation. Here we see intelligent men (which they are, make no mistake), using their considerable platforms and vast wealth to act in a way that is seemingly contradictory to their own interests. What gives? There are only two possibilities;

They’re crazy. This should not be discounted. Proximity to power is a hell of a drug. Thiel in particular (a former boss of and mentor to Sacks) has some… intriguing ideas about the optimal structure of world society, and google “Ben Horowitz transexual child” then try and resist the urge to vomit in your mouth.

There’s an incentive we haven’t yet seen.

Assets

Venture capital is a tough business. It requires being a trend-spotter, a technologist, a practitioner of business as a contact sport, and endless, endless ability to sell. Sometimes, these factors come together in the forms of VCs putting a lot of money into something that’s revealed shortly thereafter as being objectively dumb.

You might think of Theranos, Juicero, Bird Scooters, or perhaps the $7.6bn that A16Z has invested in crypto across four funds.

Imagine for a moment that you’re a venture capitalist. You own a lot of overpriced (check out those covid valuations!) startup equity, and liquidity in the same is down by 80%. Institutional capital has rotated away from your space, the SPAC trends left a bad taste in a lot of mouths, and this past week marked only the 3rd SaaS IPO in the past 3 years. Yes, seriously.

It’s going to take a long, long time before you can turn a profit on your startup stock, if ever.

What you do have is time. VC funds run on ~10 year cycles, and firms with the pedigree of A16Z and their peers can certainly ask for another year or three, and likely get it. So this is not an immediate problem, but it is a looming one, and it’s certainly true that LPs are asking more, and more difficult questions of their fund managers. While we struggle to find much sympathy for extraordinarily wealthy fund managers who are in this situation largely as a result of yoloing money into bad startups at 100X revenue valuations, it’s a tough spot. Losing sight of fundamentals is how companies die, no matter how long the feedback loops.

So… what to do?

If you also happen to billions of dollars in an alternate asset class, one completely divorced from business fundamentals and therefore able to skyrocket in price quickly…. Do you turn there?

Crypto

We’re not here to debate the merits of cryptocurrency. We’ll simply note that, out of all the proposed use-cases for digital currency, the one closest to being realized appears to be that of a hedge against falls in the broader US economy. It is generally the case that recessions send retail capital shooting into alternate assets; gold, fixed-income instruments, land, real estate and the like. Crypto has only been through one recession while adopted at any scale, and appears to follow a similar pattern.

It’s also limited in supply, has no underlying fundamentals upon which it can be judged, and is uniquely subject to market manipulation by those with large audiences, low ethics, and something to gain. Anyone else remember when Elon sent the patently absurd Dogecoin shooting upwards in price with a few tweets?

Just as we have good data showing that Harris is likely to be far better for the US business climate and stock market, we can say that Trump will be good for crypto. For one thing, he spoke at a crypto conference a few days ago. For another, he has promised to govern international economic policy through the application of tariffs, an enormously complex subject which he both does not understand and wants to use broadly. Tariffs are inflationary and recessionary, as are the skyrocketing prices of computer chips in the case of any disruption in the delicate relations between the US, China, and Taiwan.

Crypto is also a countercultural tool. Plummeting equity prices, tax hikes for the middle class, and percolating identity politics leave people angry and scared, and seeking alternative places to stash money that are not regulated by the US government. Crypto to the moon.

A16Z owns a lot of crypto and adjacent assets, and Peter Thiel started a feud with iconic investor Warren Buffet a few years ago over the latter’s rejection of the crypto value proposition. Buffet, delightfully, appeared only vaguely aware of who Thiel is. We should all aspire.

To be specific, Andreesen Horowitz could take a 50% write-down in the value of their traditional technology portfolio, create a 3X increase in the value of Bitcoin, neither of which strike us as crazy, and come out in the green.

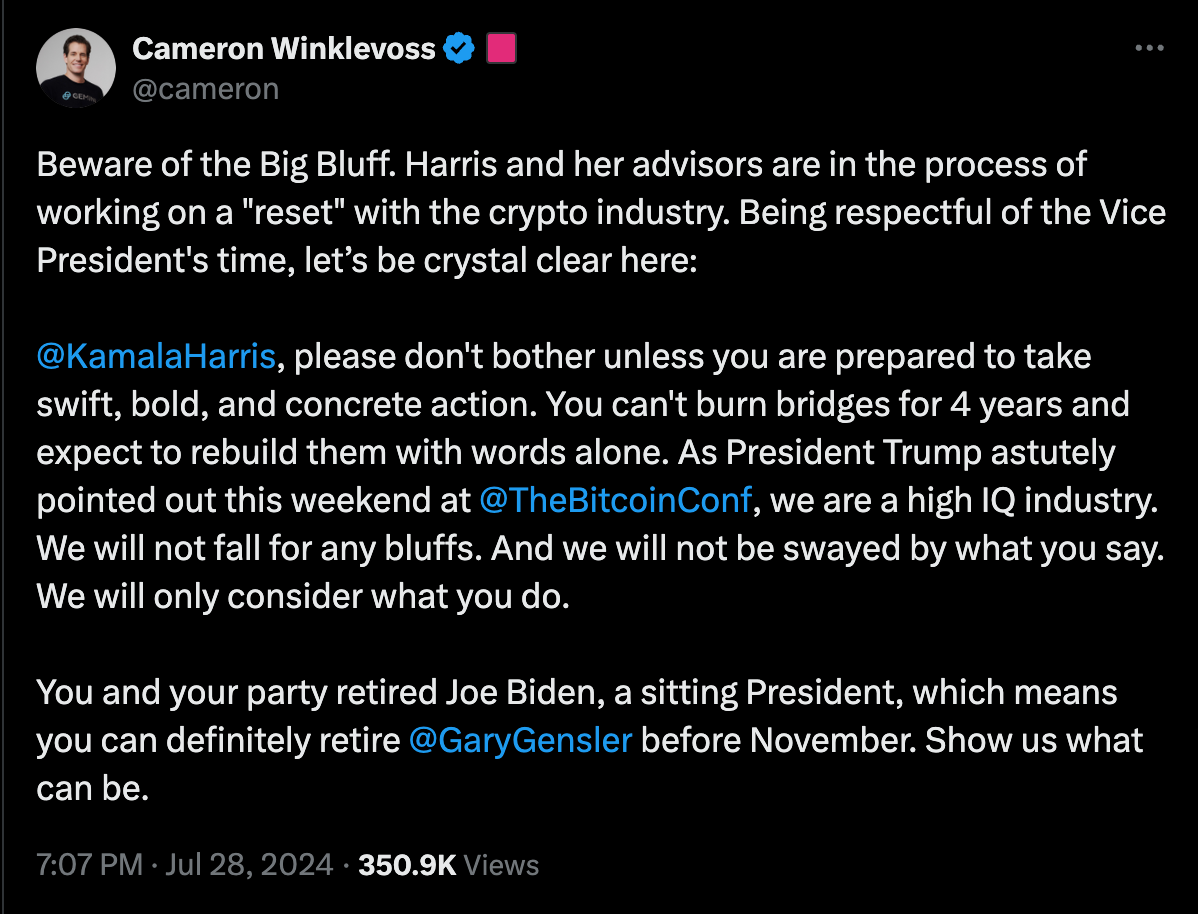

Incentives create behavior. Here’s the latest political take from the Thiel-adjacent Winklevoss brothers, who are purported to own some ~1% of all Bitcoin. Oh, and who also founded a crypto company, Gemini, which became insolvent two years ago through its’ participation in an outright Ponzi scheme run by an exchange called Genesis, and about which the SEC has thoughts.

Far be it from us to question the motivations of an infamous asshat who got rich by suing someone, richer by investing in scammy bullshit, and who is engaging in open market manipulation in order to raise the value of his last remaining asset before the SEC and IRS go full-on old testament. But we do have to wonder.

Consequences

Early-stage funding is, at the moment, a zero-sum game. There is a lot less money, with a materially more conservative stance on risk, than ever before. Climate companies are struggling to raise, to close clients, and to reach stages at which they decide their own destiny.

We’ve done our tiny part to try and help climate builders and allocators navigate this landscape, from getting to GTM traction faster, raising from alternate investment bases, and optimizing fund structures for maximum impact. It’s still tough. The feedback loops on structural ecosystem changes are very, very long.

Realistically, a climate fund that begins raising today will top out at perhaps $250m in capital commitments, and that’s assuming an extraordinary pre-existing track record. Most will be much smaller. That’s a drop in the bucket, and these commits will be very hard to obtain given get-rich-quick schemes available elsewhere.

For climate tech to work, we need a strong economy to increase the size of the overall pool. Fighting over individual cups of water will not work. We’ve started to see the ambitious companies of 2019-2023 dry up. One more super-cycle of recession and capital being largely allocated to crypto bullshit, and we’re going to lose a decade of progress. Yes, it’s bad.

Morals

We don’t get paid to write Coral. Our audience is reasonably large, highly engaged, professionally accomplished, and more than sufficient to support sponsors or a paywall… but we just don’t. We’re certainly not saints (the consulting clients we’ve met through our writing pay quite well), but making a buck has never been the point.

We made our way into the climate tech ecosystem because we, both the two of us specifically and the world at large, need it to work. We need many, many shots on the goals of abundant clean energy, GHG being sucked out of the sky, our forests growing instead of burning, and our food needs met forever.

If someone can solve one of these extraordinary problems, we wish them prosperity and fortune. Like, 747 full of cash levels of fortune.

For everyone else, especially those who already have so much and are actively stopping everyone else from working on necessary solutions to climate change; Grow up, get out of the arena, go sit and count your money. The rest of us have work to do.

Wrapping up

This is an unusual, long, ranty piece. Sorry. We’ll return to your usual programming of great companies, GTM frameworks, tactical advice, and futurism soon. For now, we’ll leave you with a few thoughts.

Just because someone has achieved success in business does not make them ethical, credible, or honest. Be deeply skeptical of gurus of all kinds.

If you’re an operator considering your next role, vote with your feet. It is not difficult to identify the backers of early-stage companies.

Allocators, we need you most of all. If you have capital commits to VC, ask your GPs for updated portfolio valuations based on Black-Scholles analysis, dated this year and preferably this quarter. Get specific. Get mean. Ask about their crypto holdings, if any, and about realistic timelines to liquidity. Make sure that you’re reviewing the composition of any fund vehicle in which your money sits. Get into the PortCos CRMs, examine pipeline and close rates, and make sure that the fund-level projections tie back.

Anyone considering writing a check to a fund manager blurring the lines between their personal support of Donald Trump and their business dealings… ask them to explain, in great detail, their precise thesis as to how this will boost returns. This isn’t a political diatribe, simply good business.

As always, thanks for reading, and back to something more optimistic in our next installment.

Please consider forwarding this piece to a friend or tossing it on the social platform of your choice. Coral Carbon is free and always will be, and every subscriber helps us keep doing this. If you want to work with us directly, stop by our new online home;

https://www.coralcarbon.io/